The year 2026 is a great chance to start a new hobby or improve your current one. If you are a numismatist or an aspiring coin lover, don’t miss this opportunity to strengthen your skills and increase your collection’s value.

You might start a new themed set, learn new coin value lookup technologies, or move to investments from a pure hobby — there are a lot of options on today’s market. Let’s overview the expectations of the upcoming year and professional forecast to prepare ourselves!

Semiquincentennial Releases: The Headline Trend of 2026

The U.S. Mint prepares to launch a major lineup commemorating the 250th anniversary of American independence. These coins follow the legacy of the 1976 Bicentennial program and are expected to draw intense attention from the broader public.

Key reasons these releases matter:

- Anticipated high demand for first strikes, proofs, and limited-edition sets.

- Designs referencing early American iconography and historic reverses.

- Strong potential for 20–30% short-term appreciation due to media exposure.

- PCGS and NGC graded coins offer affordable entry levels, many priced under $100.

Collectors should plan to:

- Order proof sets as soon as the Mint opens subscriptions.

- Monitor early reviews from grading services to identify standout issues.

- Track special packaging releases that often sell out quickly.

These coins form the backbone of many 2026 collections, serving both as patriotic keepsakes and strategic investment pieces.

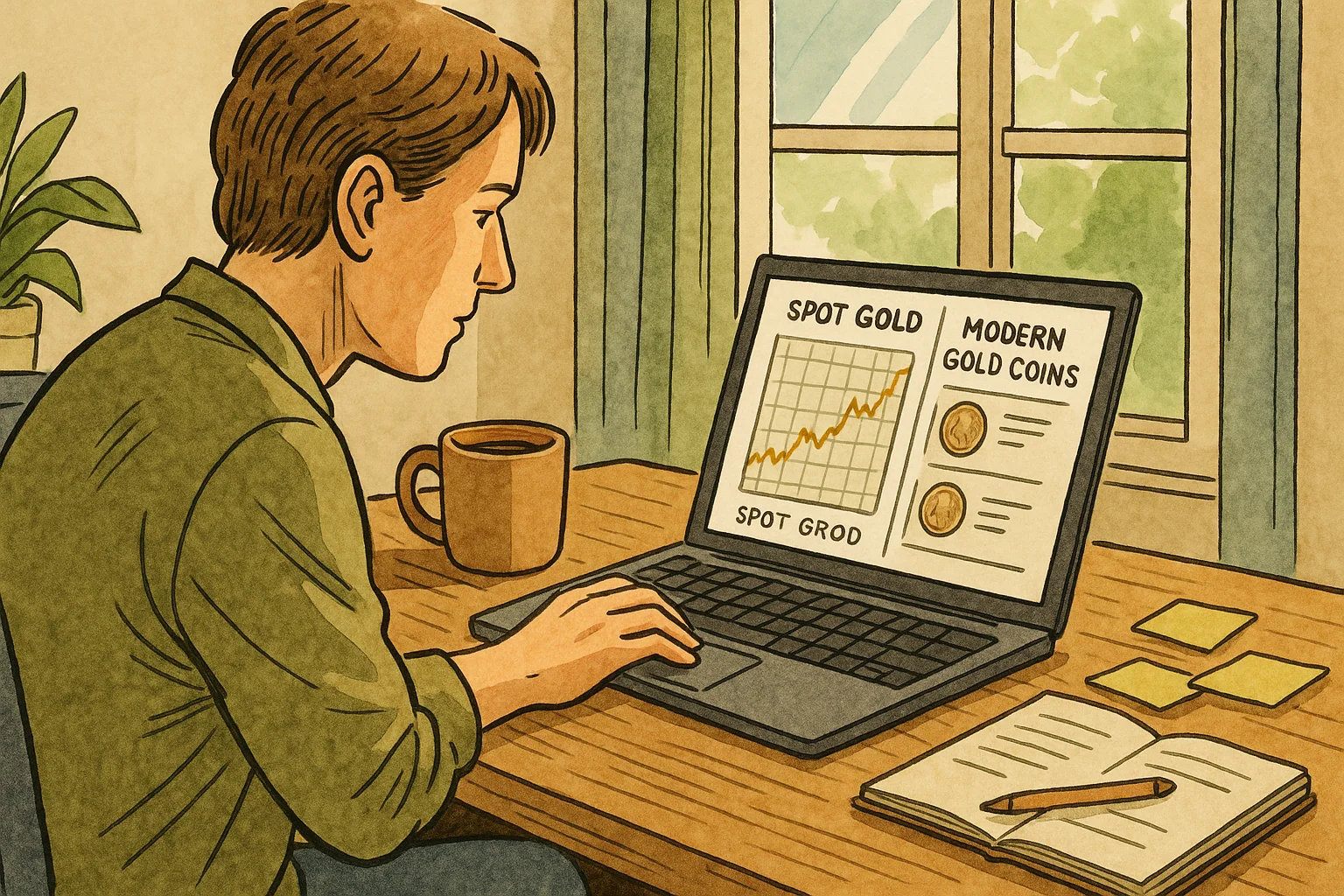

Bullion–Numismatic Hybrids: The Shift Toward Value-Based Collecting

Premiums on traditional bullion continue to compress, pushing many collectors toward hybrid pieces—coins with intrinsic metal value supported by low mintages or collectible designs. This trend strengthens in 2026 as gold forecasts move into the $3,700–$4,000 per ounce range, attracting more attention to modern numismatic issues.

Notable opportunities include:

- Low-mintage modern gold and silver coins offering dual value appeal.

- The 2026 British Sovereign, shifting to yellow gold and gaining renewed investor interest.

- Bulgaria’s euro-adoption coinage featuring the Madara Rider, likely to become a first-year collectible.

- Regional price gaps in U.S. and U.K. auctions, creating buy-low windows for savvy collectors.

A simple comparison highlights the benefit:

| Category | Bullion | Bullion-Numismatic Hybrid |

| Price Stability | Directly tied to spot | More resilient during dips |

| Long-Term Growth | Moderate | Higher upside due to rarity |

| Collector Demand | Broad | Increasing sharply in 2026 |

| Ideal For | Metal-focused buyers | Balanced collections |

This shift encourages collectors to focus on coins that provide both portfolio stability and artistic or historical appeal.

Digital and AI Integration: Smarter Collecting in Real Time

Technology plays a major role in shaping collecting habits in 2026. Faster research, real-time pricing, and on-the-go verification help collectors make better decisions at shows, auctions, and online markets. This shift expands the hobby and removes many barriers that slowed beginners in earlier decades.

The best free coin identifier app for iPhone and AI-based platforms reshape how collectors verify coins, track value, and build sets. These tools reduce research time and improve accuracy, especially for modern issues where subtle design changes matter.

Key advantages of digital tools:

- Instant photo identification of coins with clear results

- Access to mint years, metal data, weight, and value ranges

- Easier comparison between varieties and special releases

- Real-time auction tracking to prevent overpaying

These features make it easy for collectors to research new Mint releases and verify purchases at events.

Error Coins and Modern Varieties: Rising Demand for Unusual Pieces

Modern mints continue introducing colorized designs, proof exclusives, and limited thematic sets. At the same time, collectors show growing interest in errors, varieties, and unexpected minting anomalies, especially those linked to 2025–2026 issues.

Key trends shaping this segment:

- Increased attention to CIT’s 2025 colorized designs, which continue into 2026.

- Strong demand for World Cup–related commemoratives, boosting global liquidity.

- Premium growth for low-mintage proof sets, often exceeding 15% annual gains.

- Ongoing interest in statehood successors and regional-themed quarters.

Collectors expanding into these categories should maintain a strategic allocation, often around:

- 5–10% of the portfolio dedicated to error coins and modern high-upside varieties

This range balances fun and investment potential without exposing the collection to unnecessary volatility.

The combination of AI verification via the coin value app Android, rising global commemoratives, and specialty mint releases creates a unique moment for collectors. It becomes easier to:

- Discover new series early

- Track value changes across global markets

- Compare purchase prices with auction performances

- Build thematic collections centered on current events

Modern tools amplify access, while new minting technologies and global celebrations create constant opportunities for meaningful additions.

Strategic Portfolio Allocation for 2026

Building a coin collection in 2026 is not only about selecting attractive releases. It also requires structure, balance, and a clear understanding of how different segments behave in changing markets. With gold forecasts climbing and global mints expanding their programs, collectors benefit from setting rules that guide purchases throughout the year.

A balanced approach helps reduce risk and improves long-term outcomes. Many collectors follow a diversified model:

| Category | Suggested Allocation | Why It Matters |

| Classics (Pre-1965 U.S., early world coins) | 40% | Strong historical demand and proven long-term appreciation |

| Modern Numismatics | 30% | Rapid growth driven by Semiquincentennial designs and new mint technologies |

| Bullion (gold, silver) | 20% | Stability during market volatility and rising metal forecasts |

| Emerging Issues (euro first-year coins, new series) | 10% | High upside potential at low entry prices |

How to Build a Forward-Focused Collection

A practical 2026 collecting plan includes:

- Prioritizing early ordering of Semiquincentennial proofs and limited sets

- Watching for undervalued moderns that pair low mintage with strong design appeal

- Monitoring regional auction results for price gaps between U.S. and European markets

- Using grading services to increase liquidity on top-tier pieces

- Tracking AI-based valuations to avoid inflated premiums

Coins linked to historical milestones or global debuts often remain relevant long after release. This makes them excellent anchors for a growing collection.

Why Grading Matters More in 2026

With demand rising for modern issues, certified examples are gaining value faster than raw pieces. PCGS and NGC slabs:

- Enhance resale confidence

- Protect coins from environmental damage

- Provide reliable grade documentation

- Increase marketability at online auctions

Collectors planning to sell in the long term should consider grading key Semiquincentennial coins, modern proofs, and standout error varieties.

Final Tips for a Successful 2026 Collection

A strong collection thrives on consistency and informed choices. Collectors should:

- Store coins securely with insurance protection

- Keep digital and printed records of purchases

- Compare prices across multiple auction platforms

- Rebalance portfolios at mid-year as premiums shift

- Study mintage numbers and production announcements early

The year’s combination of national celebrations, rising bullion interest, and expanding digital tools creates an unusually rich environment for collectors. Coins released or discovered in 2026 are poised to influence the market for years to come.